For most of my analysis, I’ve only concentrated on looking at the short term charts. This time around, I’ll try to get the bird’s eye view of the stock and hopefully see what future may lie upon it. The first stock I’d like to put on the spot light is MERB.

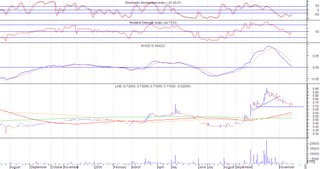

MERB Weekly Chart

The recent movement of MERB has been very bullish that it had me looking at the past as to whether this bullishness is somehow part of what kind of trend. As taught to me by the masters of

absolute trading, there are only 3 ways where the stock would go, either up, down or sideways. Looking at MERB’s chart from 1992, it somehow surprised me that there really is something brewing for this stock. The downward trend from 1997 has been broken by 2003 and from then on, the stock has now started to slowly move sideways to up. A higher low has been established last May 2006 which suggest that the recent bullishness might be part of an upward trend. One thing left to confirm this upward trend is for the stock to break the 2004 resistance of 37.50 which is P0.50 away from last Friday’s price movement.

It is interesting to note that the price movement from 2003 up to current seems to be forming an ascending triangle. If the resistance at 37.50 is not broken, and the price starts to move down, this might be a confirmation of the ascending triangle, that it is still consolidating and it may take a year or two before the resistance is re-tested.

Its a wait and see for the 37.50 resistance will be broken.

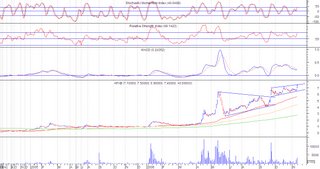

VUL( Chart: Daily Resistance: 0.98 Support: 0.83)

VUL( Chart: Daily Resistance: 0.98 Support: 0.83)

APXB ( Chart: Daily Resistance: 7.50 Support: 6.50)

APXB ( Chart: Daily Resistance: 7.50 Support: 6.50) PX ( Chart: Daily Resistance: 5.00/5.50 Support: 4.30/4.00)

PX ( Chart: Daily Resistance: 5.00/5.50 Support: 4.30/4.00) MEG( Chart: Daily Resistance: 2.44 Support: 1.96)

MEG( Chart: Daily Resistance: 2.44 Support: 1.96)