MERB (Chart: Daily Resistance: 37.50 Support: 35/33/31)

MERB has broken an ascending triangle with volume, but not enough to characterize a good breakout. A pennant has also been formed, broken with very good volume and reached its target price. The things to look out for are the following: A. Another pennant formation. If this happens, then 37.50 resistance (previous high of 2004) can be easily broken. B. Downward movement if 37.50 is not broken. We could see a downward movement if 37.50 has not been successfully broken. Hopefully, it would just be a move towards the 35/33/31 support level. Any move further downward might result into a year long consolidation between 37.50 and 20.

MERB has broken an ascending triangle with volume, but not enough to characterize a good breakout. A pennant has also been formed, broken with very good volume and reached its target price. The things to look out for are the following: A. Another pennant formation. If this happens, then 37.50 resistance (previous high of 2004) can be easily broken. B. Downward movement if 37.50 is not broken. We could see a downward movement if 37.50 has not been successfully broken. Hopefully, it would just be a move towards the 35/33/31 support level. Any move further downward might result into a year long consolidation between 37.50 and 20.

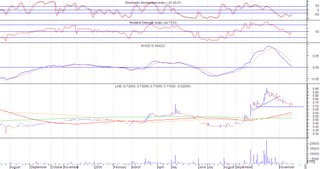

LND ( Chart: Daily Resistance: 0.96 Support: 0.69 )

Interesting to note: The downward price movement is not accompanied by volume, which suggests that people are still holding on to the stock at 0.8-0.9 level. Currently price is now at 0.7 level and based on SMI we might see an upward move for this stock again.

Interesting to note: The downward price movement is not accompanied by volume, which suggests that people are still holding on to the stock at 0.8-0.9 level. Currently price is now at 0.7 level and based on SMI we might see an upward move for this stock again.

GSMI (Chart: Daily Resistance: 21 Support: 18)

This is one stock to avoid, for now. GSMI gapped down with volume, which is a very very bearish event. Probably wait for the price to go down to 18-19 level before going in.

This is one stock to avoid, for now. GSMI gapped down with volume, which is a very very bearish event. Probably wait for the price to go down to 18-19 level before going in.

No comments:

Post a Comment